washington estate tax return due date

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. If a Washington state estate tax return is required your executor will have to either file it nine months after the date of death or apply for an extension of six months.

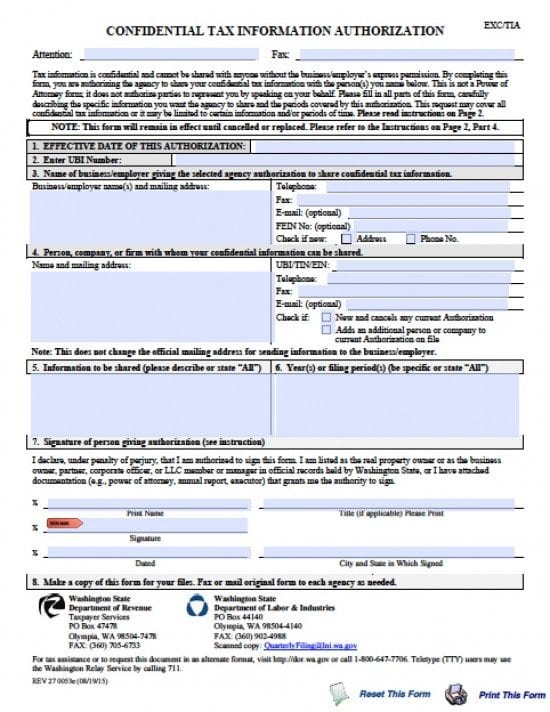

Washington Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

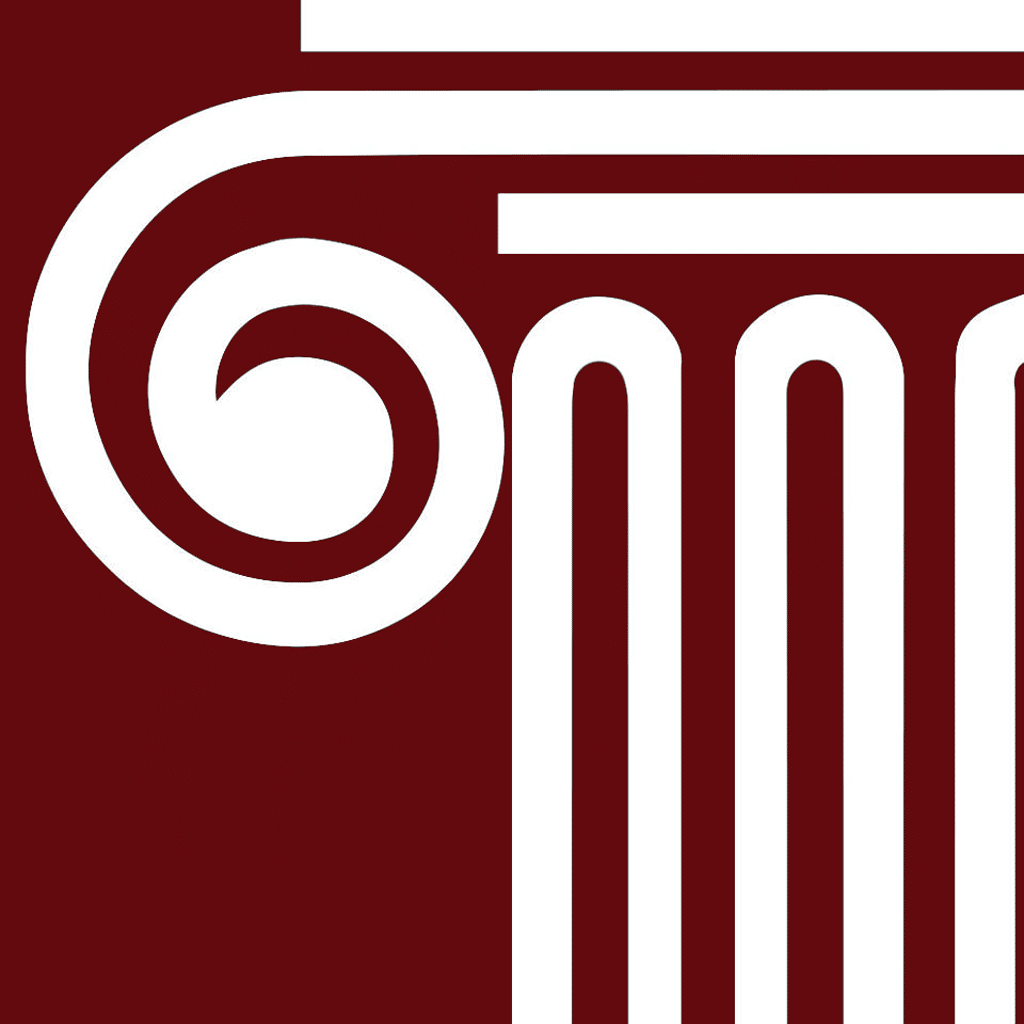

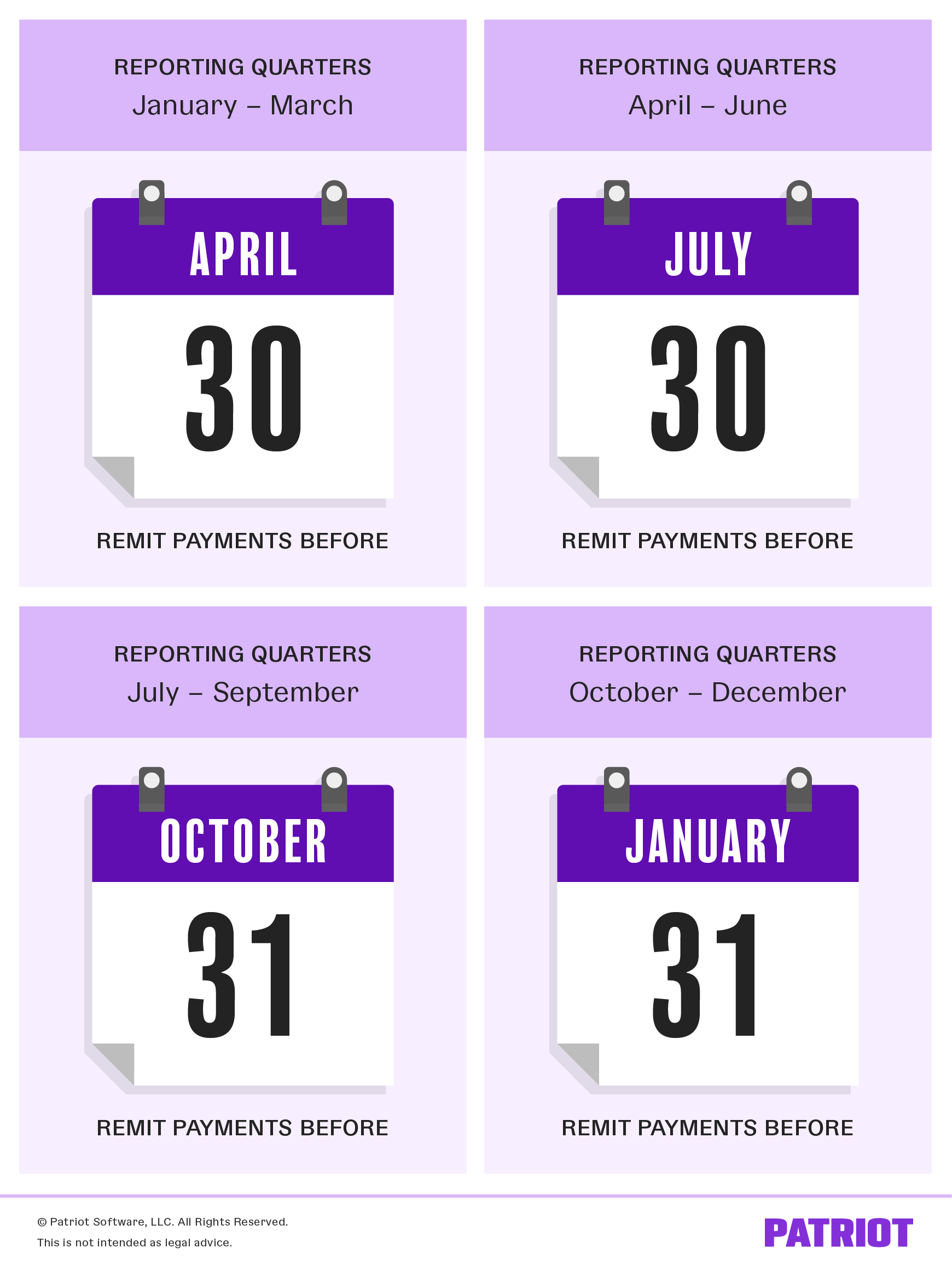

March 2022 return.

. The return is due nine months after the date of death of the decedent. RCW 8412230 and 260. Report income distributions to beneficiaries and to the IRS on.

Nonprofit property tax exemption applications are due March 31. 31 rows Generally the estate tax return is due nine months after the date of death. However a trust or an estate may also have an income distribution deduction for distributions to beneficiaries.

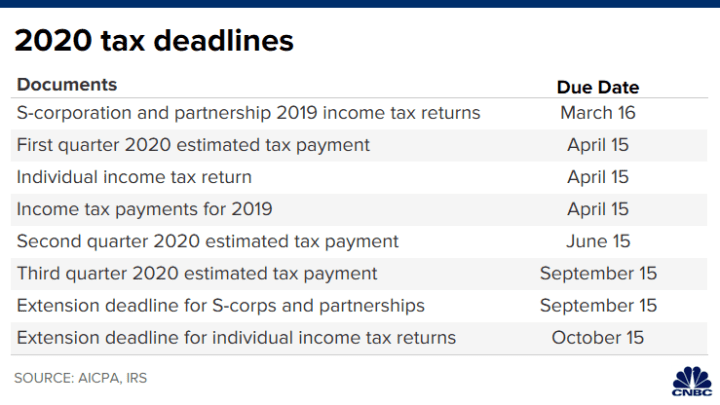

The due date of the Washington State Estate and Transfer Tax Return is nine months after the date of death. The 5-year deferral for payment of the tax as discussed later under Time for payment. The federal estate tax exemption is 1170 million in 2021 going up to 1206.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will. Addendum 1 - Qualified Terminable Interest Property QTIP or Qualified Domestic. Utility company annual returns are due March 15.

The Washington estate tax is not portable for married couples. Here you can check your filing due dates to make sure your tax return gets in on time. If the executor makes this election the first installment payment is due when the estate tax return is filed.

When both spouses die only one exemption of 2193 million applies. Application for Extension of Time to File a Washington State Estate and Transfer Tax Return Note. An extension gives your executor more time to file the completed return but estimated tax must still be paid by the original due date.

The Washington estate tax is not portable for married couples. A timely filed extension application. Its important to know when your taxes need to be filed.

In addition to the Washington estate tax there is a federal estate tax you may have to pay but the exemption is much higher. If a Washington state estate tax return is required your executor will have to either file it nine months after the. What is the due date for the estate tax return.

The return is filed with the Department of Revenue Audit Division PO Box 47474 Olympia WA 98504-7474. A The Washington estate tax return state return must be filed with the Washington state department of revenue department if the gross estate of a decedent equals or exceeds the. For returns filed on or after July 23 2017 an estate tax.

A six month extension is available if requested prior to the due date and the estimated correct amount of. The Washington estate tax return state return referred to in RCW 83100050 and a copy of the federal estate tax return federal return and all supporting documentation is due nine months. 13 rows Only about one in twelve estate income tax returns are due on April 15.

Date death occurred.

Important Tax Change For Businesses Filing Annually Nfib

Washington State Estate Tax Guide 2019 Inheritance Tax Moulton Law

Washington State Sales Use And B O Tax Workshop

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Seattle Wa Blog Bank Ideas Seattle Business Apothecary Resource Center For Self Employed Women

File Pay Taxes Washington Department Of Revenue

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Washington Paid Family Leave Family And Medical Leave Rules

Account Id And Letter Id Locations Washington Department Of Revenue

Washington Estate Tax Update For 2022 Stacey Romberg

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Federal Income Tax Deadlines In 2022

Washington Estate Tax Everything You Need To Know Smartasset

Free Washington Vehicle Boat Bill Of Sale Pdf Eforms

Tax Deadlines Are Likely To Change Here S What You Need To Know

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Washington State S New Capital Gains Tax A Primer Crosscut

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Account Id And Letter Id Locations Washington Department Of Revenue

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities